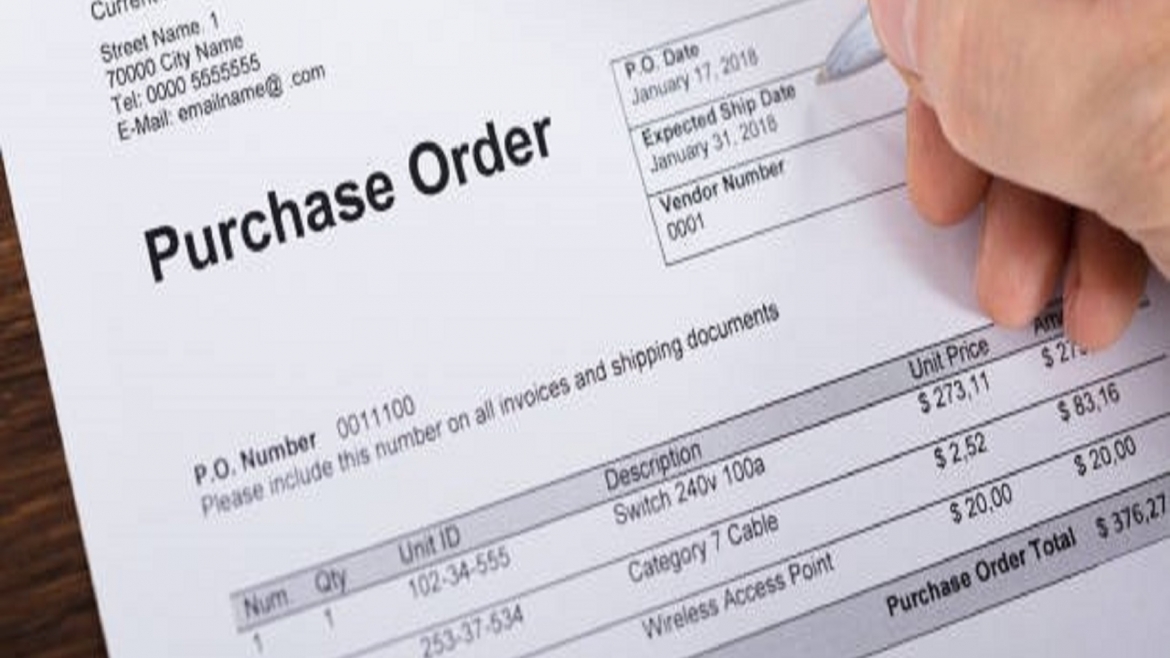

An Local Purchase Order (LPO) loan is a type of financing that enables businesses to fulfill orders from their customers by providing the necessary funds to purchase goods and services required to complete the order.

If a customer gets an LPO loan from City Access, they can benefit in several ways. Firstly, the customer can access the funds they need to fulfill their orders promptly without having to wait for payments from their clients. This can help to improve their cash flow and prevent delays in delivery, which can affect their business reputation negatively.

Secondly, City Access can provide customers with flexible repayment terms that are tailored to their business needs. This means that customers can choose a repayment schedule that works for them, whether it’s weekly, monthly, or quarterly. This can help to reduce the financial strain on the business and make it easier to manage their cash flow.

Additionally, City Access can offer competitive interest rates on their LPO loans, helping customers save money on interest charges. This can help businesses to increase their profit margins, which can be reinvested back into the business for growth and expansion.

Overall, our LPO Finance offers credit facilities to finance local purchase orders or contracts involving the supply or delivery of visible items or products whose specifications are set out in the contract agreement or document.

Features:

- Valid LPOs from reputable institutions.

- Loan Amount does not exceed 70% of contract amount.

- Tenor and repayment terms are subject to the terms and conditions of the Order.